Payroll calculation with example

So Tax Rate 15 and deduction 14250. Discover ADP Payroll Benefits Insurance Time Talent HR More.

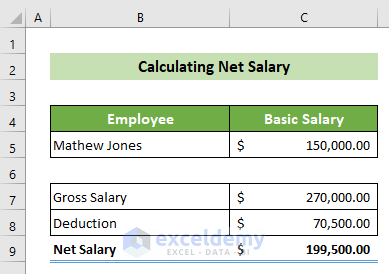

Salary Formula Calculate Salary Calculator Excel Template

28429 x 02965 8429 total tax withheld 28429 8429 200 net.

. Answer A Few Easy Questions We Will Match You With Our Top Payroll Service Providers. Free Unbiased Reviews Top Picks. Ad Process Payroll Faster Easier With ADP Payroll.

By referring to the above table we can see that 2000 birr falls in the No. Holiday Pay HOL Time is always paid to an employee. Ad Compare This Years Top 5 Free Payroll Software.

Ad Prevent Expensive Mistakes With Unlimited Guidance and Support From Uour HR Manager. Payroll Seamlessly Integrates With QuickBooks Online. Employee1 works for an organisation for 6 years and 9 months and the last drawn salary is Rs50000.

Find The Best Payroll Software To More Effectively Manage Process Employee Payments. LoginAsk is here to help you access Example Of Payroll Accrual. Taxes Paid Filed - 100 Guarantee.

Ad Process Payroll Faster Easier With ADP Payroll. Six hours worked at overtime rate of 225 per. Payroll calculations are defined as the various numbers and processes that are performed by an employer the sum of which equals an employees pay.

A Complete Step-by-Step Guide. Ad Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You. 12 rows Equals Total Hours from both pay periods worked minus 160 ONL is not considered in this.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. You use the payroll calculation frequency to select the specific pay periods when specific earnings or other payroll entities should be processed. If the salary of an employee is 2000 Birr.

Medicare Payroll Tax Example. The wages are calculated by adding the basic pay and the Allowances DA HRA Medical City Compensatory Allowance etc. Starting as Low as 6Month.

15 x 50000 x 7 26 Rs201923. Find out how easy it is to manage your payroll today. How to calculate ESI with an example Lets say.

To calculate Medicare withholding multiply your employees gross pay for the current pay period by the current Medicare rate 145. Small Business Low-Priced Payroll Service. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Ad From The Most Popular Payroll Services to Best for Small Business - Compare Costs Save. Gratuity payable will be. 1 02965 07035.

It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Example Of Payroll Accrual Calculation will sometimes glitch and take you a long time to try different solutions. 40 hours worked at regular rate of 15 per hour.

Payroll management made easy. Discover ADP Payroll Benefits Insurance Time Talent HR More. For more information about.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Get Started With ADP Payroll. 3 Months Free Trial.

Withhold 62 of each employees taxable wages until they earn gross pay. Tax Exemption Amount for Nonresident. It is a day of exemption from work for which employees are paid as if they had worked 8.

It will confirm the deductions you include on your. Get Started With ADP Payroll. 40 x 15 600.

200 07035 28429 gross payment. Ensure Accurate and Compliant Employee Classification for Every Payroll. How to Calculate Payroll.

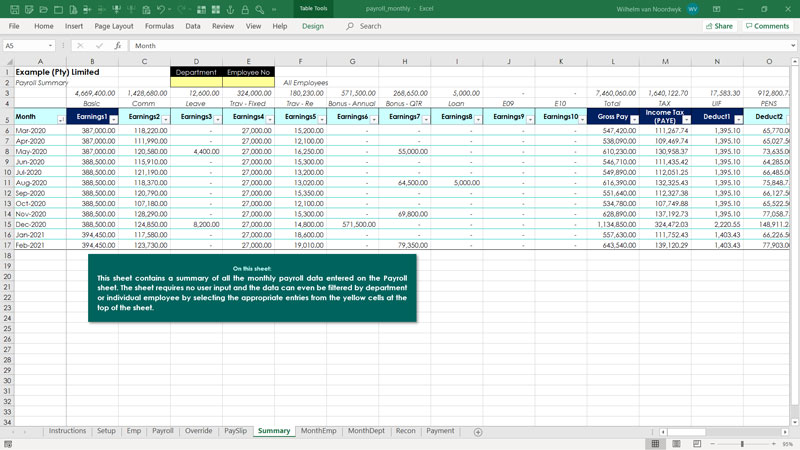

Excel Payroll Software Template Excel Skills

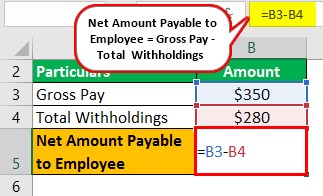

Payroll Formula Step By Step Calculation With Examples

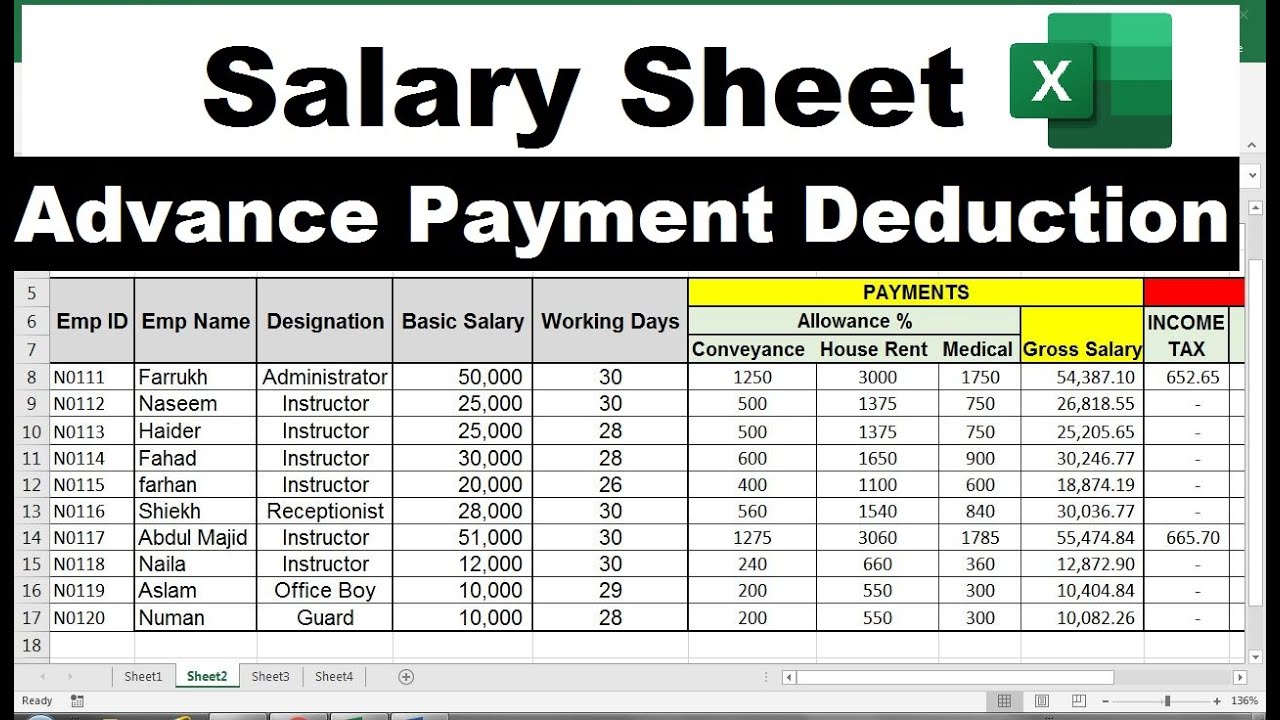

How To Make Salary Sheet In Excel With Formula With Detailed Steps

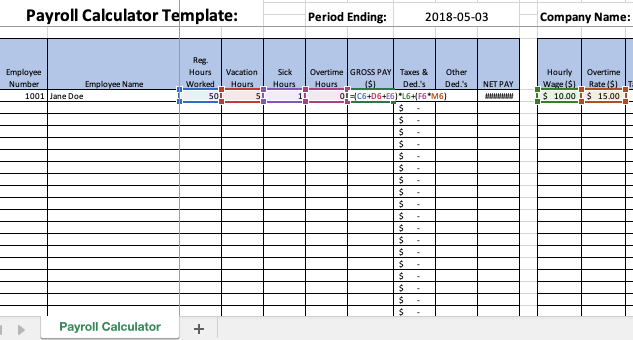

Excel Payroll Formulas Includes Free Excel Payroll Template

Salary Sheet In Excel With Formula Salary Sheet Sample Youtube

Payroll Formula Step By Step Calculation With Examples

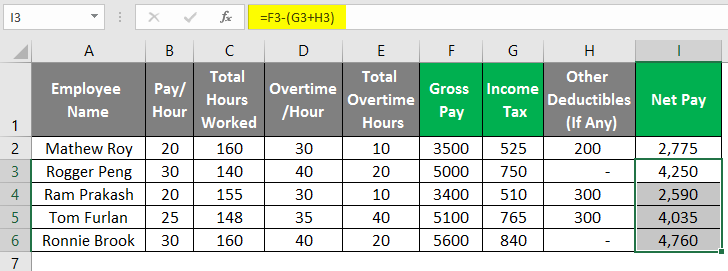

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

Different Types Of Payroll Deductions Gusto

Payroll Formula Step By Step Calculation With Examples

Payroll Formula Step By Step Calculation With Examples

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

Salary Formula Calculate Salary Calculator Excel Template

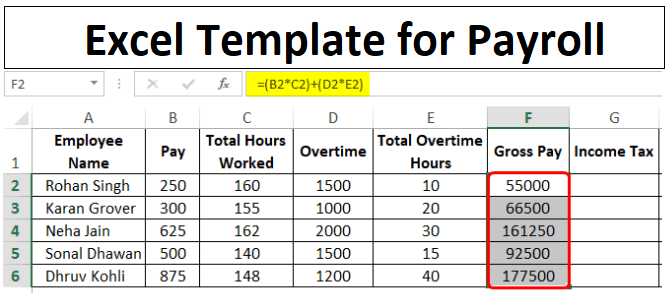

Excel Template For Payroll How To Create Payroll Template In Excel

Payroll In Excel How To Create Payroll In Excel With Steps

Payroll Budget Template Example Uses