What is my home loan borrowing capacity

A lender will calculate your borrowing power by taking into account your income and expenses. Typically borrowing power depends on.

5 Ways To Get A High Lvr Home Loan Credit Repair The Borrowers Loan

If you need any assistance with this Id be.

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

. Ad Apply For A Small Business Loan From Kabbage. Well Automatically Calculate Your Estimated Down Payment. It is a main component to determine the type.

Plans Platinum Gold and Silver. You can borrow up to 716000. The type of mortgage you choose and the loans term the length you borrow the money for also has a bearing on your borrowing power.

Learn More Apply Today. This is usually required by the courts during. This calculator helps you work out how much you can afford to borrow.

View your borrowing capacity and estimated home loan repayments. Generally to be considered your income must be ongoing and regular. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI. Increase your borrowing power by reducing the number of additional features on your home loan extending your loan term and improving your credit score. Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan calculated generally as your net income income after tax minus your.

For a conventional loan your DTI ration cannot exceed 36. With rates constantly changing every month some people might be really confused as to what their borrowing capacity is in this market. Compare home buying options today.

Borrowing capacity is defined by the amount you can obtain from your bank to finance the purchase of your future home. Try Our Fast Easy Online Mortgage Application. Ad Compare Reviews of the Best Business Loans.

Everyones borrowing power for a home loan is different. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. A Mortgage Capacity Report is a document which provides details from a number of lenders on how much you can borrow as a single applicant.

Ad Great interest rates. Estimate how much you can borrow for your home loan using our borrowing power calculator. Results do not represent either quotes or pre-qualifications for the product.

Borrowing capacity and affordability may seem like they are interchangeable but they are not. Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt. Other factors like your credit score and whether you have a.

Increasing your income is a great way to boost your borrowing capacity. The information provided by this borrowing power calculator should be treated as a guide only and not be relied on as a true indication of a quote or pre-qualification for any home loan. Learn More Apply Today.

Ad Buying A Home. You hold a credit card with a 10000 limit and your living expenses amount to around 2000 a month. A loan with minimal features low fees.

As an expat or foreign national your borrowing power will vary from a permanent resident. Buying or investing in. It is based on your financial situation including how much you earn your expenses your existing debts and the size of your deposit.

Find A Lender That Offers Great Service. Try Our Fast Easy Online Mortgage Application. Well Automatically Calculate Your Estimated Down Payment.

Borrowing capacity is calculated by lenders based on their assessment rate. Borrowing Power Calculator The results from this calculator should be used as an indication only. Simply follow the link in your email to view your free report.

When the time comes to assess your borrowing capacity the first indicator used by financial institutions is the gross debt service or GDS. Compare More Than Just Rates. Borrowing capacity is defined by the amount you can obtain from your bank to finance the purchase of your future home.

Different lenders require different. Discover how much you can borrow for your. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

Ad Get an Affordable Mortgage Loan with Award-Winning Client Service. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. In one easy application prequalify for low-cost SBA and fixed rate term loans up to 5M.

Unos home loan borrowing calculator will estimate your borrowing capacity. Ad Buying A Home. View your borrowing capacity and estimated home loan repayments.

How To Dodge Mortgage Insurance Fees When Applying For A Home Loan Infographic Home Loans Mortgage Payment Calculator Mortgage Payment

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Home Affordability Calculator Credit Karma

Mortgage Calculator How Much Can I Borrow Nerdwallet

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Mortgage The Components Of A Mortgage Payment Wells Fargo

Cairns Houses For Sale How Hecs Can Affect Your Mortgage Borrowing Power Real Estate Photography Selling Real Estate Real Estate

Free Printable Loan Agreement Form Form Generic

Making An Offer On A House Below Asking Price In 2022 In 2022 First Home Buyer Home Loans Things To Sell

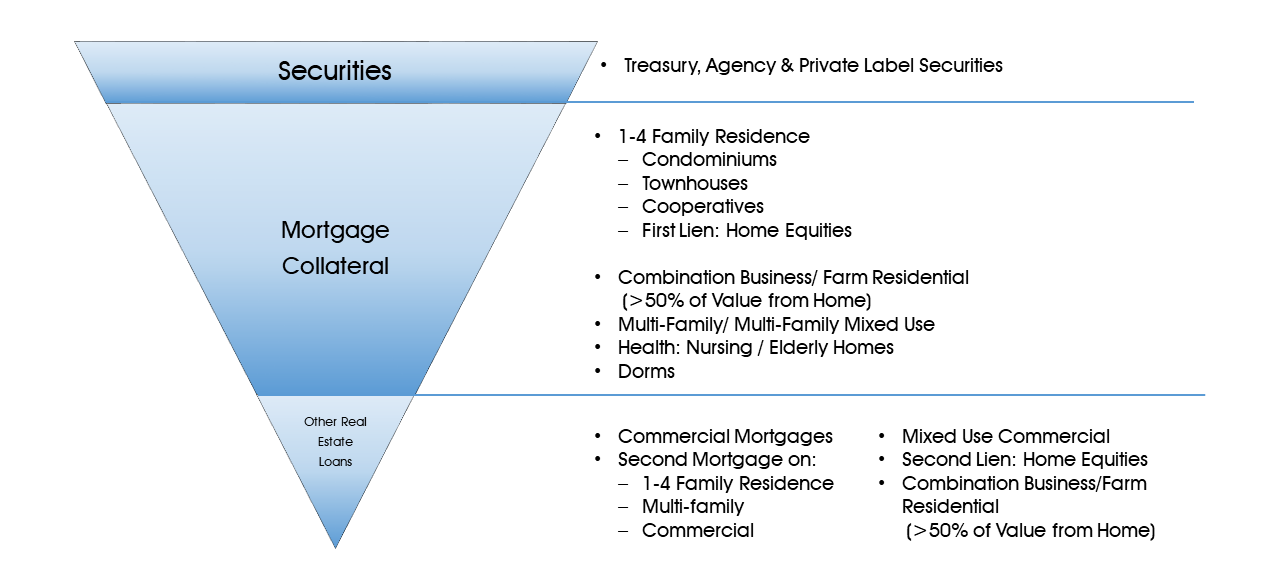

Collateral Guide Federal Home Loan Bank Of New York

![]()

Best Home Loan Interest Rate In Loanzzones Home Loans Loan Interest Rates Best Home Loans

Interested In Borrowing Against Your Home S Available Equity To Pay For Other Expenses The Good News Is You Have Ch Home Equity Line Of Credit Mortgage Payoff

Pin Su Loans Calculator Iphone Application

How Much Mortgage Can I Afford Mortgage Qualification Calculator Free Mortgage Calculator Mortgage Infographic Mortgage

Compare Apply For Loans Credit Cards And Balance Transfer Services Balance Transfer Home Loans Personal Loans Online

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

How Do Car Loans Affect Your Financial Position The Broke Generation Car Loans Financial Position Budgeting Tips